Ei Direct Deposit

On this page

To access these services in MSCA, you must sign in to MSCA and go to the EI page.

There is no one time that “most” deposits post. It all depends upon when the transaction arrives at the bank's computers and the bank's posting procedures. The Automated Clearinghouse (ACH) system runs 24 x 7 x 365. It knows no weekends or holiday. What Is Direct Deposit? Direct deposit is an electronic payment from one bank account to another. For example, money may move from an employer’s bank account to an employee’s bank account, although there are several other ways to use direct deposit.

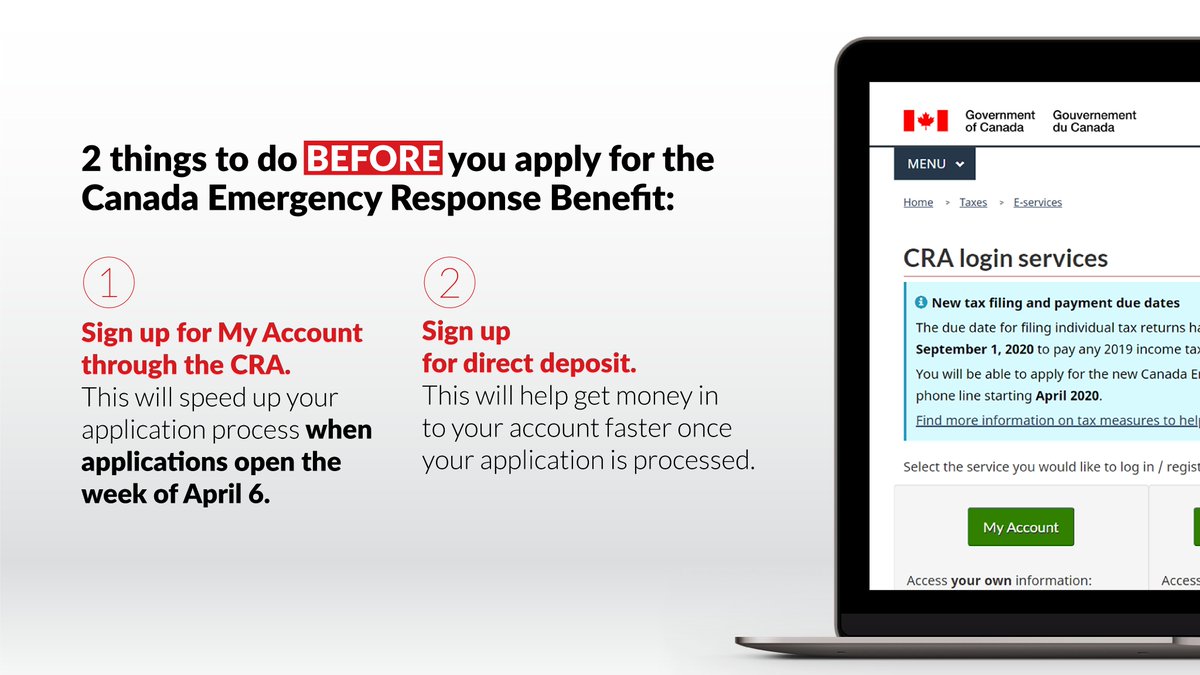

Direct deposit is a way to receive your payments without any postal delay. Not only will you be able to access your payments more quickly, you can also be sure they will never be lost, stolen or damaged. Sign up for direct deposit now! It is convenient, secure and reliable. The Government of Canada is switching from cheques to direct deposit, an electronic transfer of funds deposited directly into your bank account. Direct deposit is faster, more convenient and more secure. Enrol for direct deposit or update the banking information you already have on file. Sign up or modify details for direct deposit.

Get your tax slip online

In MSCA, you can get your T4E online by selecting Tax slip mailing options. Do this before January 1 to receive this year's T4E online. This is an official document—print it and attach it to your income tax return.

T4Es are available online in MSCA the first week of February.

Paper tax slips are mailed by the end of February. Ensure that your mailing address is correct in MSCA.

Update your personal information

When you change your mailing address or direct deposit information using MSCA, it is updated right away.

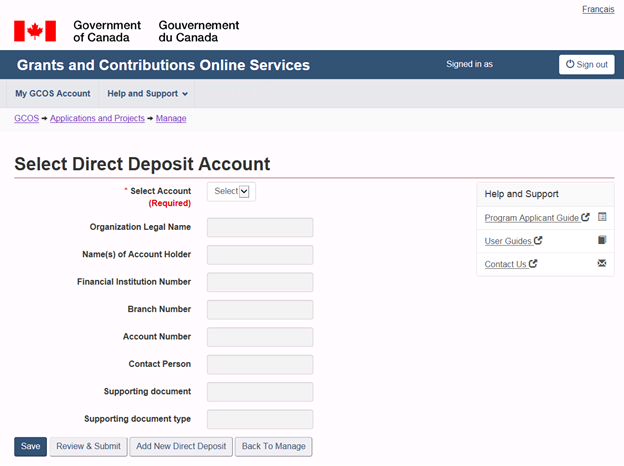

Select Direct deposit to have your EI payments deposited into your bank account. You cannot update your direct deposit information in advance.

Select Mailing address and telephone number to change your address or phone number. You must let us know of any changes if you have received EI benefits in the past year. This prevents delays in receiving benefits. It also ensures you receive your T4E for your tax return.

You can provide your future address up to 180 days in advance. Select My future mailing address and telephone number information to enter your new information and effective date.

If you moved to a new province and your claim has been transferred, you must also update your province of residence by selecting Province of residence. This ensures that you always see your most recent EI claim information.

If your home address is different than your mailing address, call 1-800-206-7218 during business hours or visit a Service Canada Centre. It can’t be updated online.

View your claim status and correspondence

You can view your EI claim status and messages by selecting View my status and correspondence. It is only available for applications submitted after November 7, 2016.

Alert Me

Select Register for Alert Me to receive email notifications for new information about your EI claim.

Alert Me emails are generic. They tell you to log in to MSCA to view your new EI claim information. You will only receive one email alert in a 24-hour period.

You can unsubscribe by selecting Unsubscribe from Alert Me on the Manage my Alert Me profile page. You can subscribe again at any time.

Information in Latest claim

Ei Direct Deposit Time Rbc

MSCA displays information about your current claim for EI benefits, such as:

- the start date

- your benefit rate

- the types of benefits

- the number of weeks paid

View previous EI claim information

The My past claims page displays your EI claims history. Select a specific claim to view available information. We remove claim information from our system after 7 years.

Additional tax taken off your payments

Ei Direct Deposit Time

If you would like additional tax to be taken off your payments, call 1-800-206-7218 during business hours or visit a Service Canada Centre.

Social Insurance Number (SIN) not displayed in EI information

We do not display your SIN in MSCA. This is because you may access your information from a public site. It is important to protect your SIN to prevent others from using it.

View your EI report and payment information

If you complete your reports online or by telephone, you can view the details by selecting Payment information. If you complete paper reports, this service is not available.

Payment information is updated the next business day once your report is processed. Processing occurs early evenings, Sunday to Thursday. If you file your report on Friday or Saturday, your payment information will appear on Monday.

Please note that holidays can affect our processing schedule.

Apply for EI

The link to apply for EI is available on the right-hand navigation bar in MSCA. For security reasons, this link will ask you to leave MSCA and log in to apply for EI separately. You can also apply for EI by accessing the application online.

Complete your EI and CERB reports online using the Internet Reporting Service

The link to complete your EI and CERB reports is available on the right-hand navigation bar in MSCA. This is the link to the Internet Reporting Service. For security reasons, this link will ask you to leave MSCA and log in separately to complete your reports. You can also complete your reports directly through the Internet Reporting Service.

Service Canada Direct Deposit Form

Maternity/paternity benefits from Quebec Parental Insurance Plan

The Province of Québec is responsible for providing maternity, paternity, parental and adoption benefits to its residents. Visit the Québec Parental Insurance Plan for more information.

Language preference for written communication

You can change your official language preference by selecting Preferred language.

Use eForms to provide information

If you are receiving EI benefits, you can provide information about:

- an absence from Canada

- a course or training program that you are attending or will be attending within the next 28 days

- other parents for parental benefits

You can save a draft of your eForm. It will be available to edit for 24 hours. You can only save 1 draft of each eForm at a time.

You can view and print eForms that have been submitted within the last 2 years.

Certain eForms may not be displayed depending on your benefit type. They are not available for maternity and caregiving benefits.

To provide information regarding your claim, call 1-800-206-7218 during business hours or visit a Service Canada Centre.