Deposit Check Online

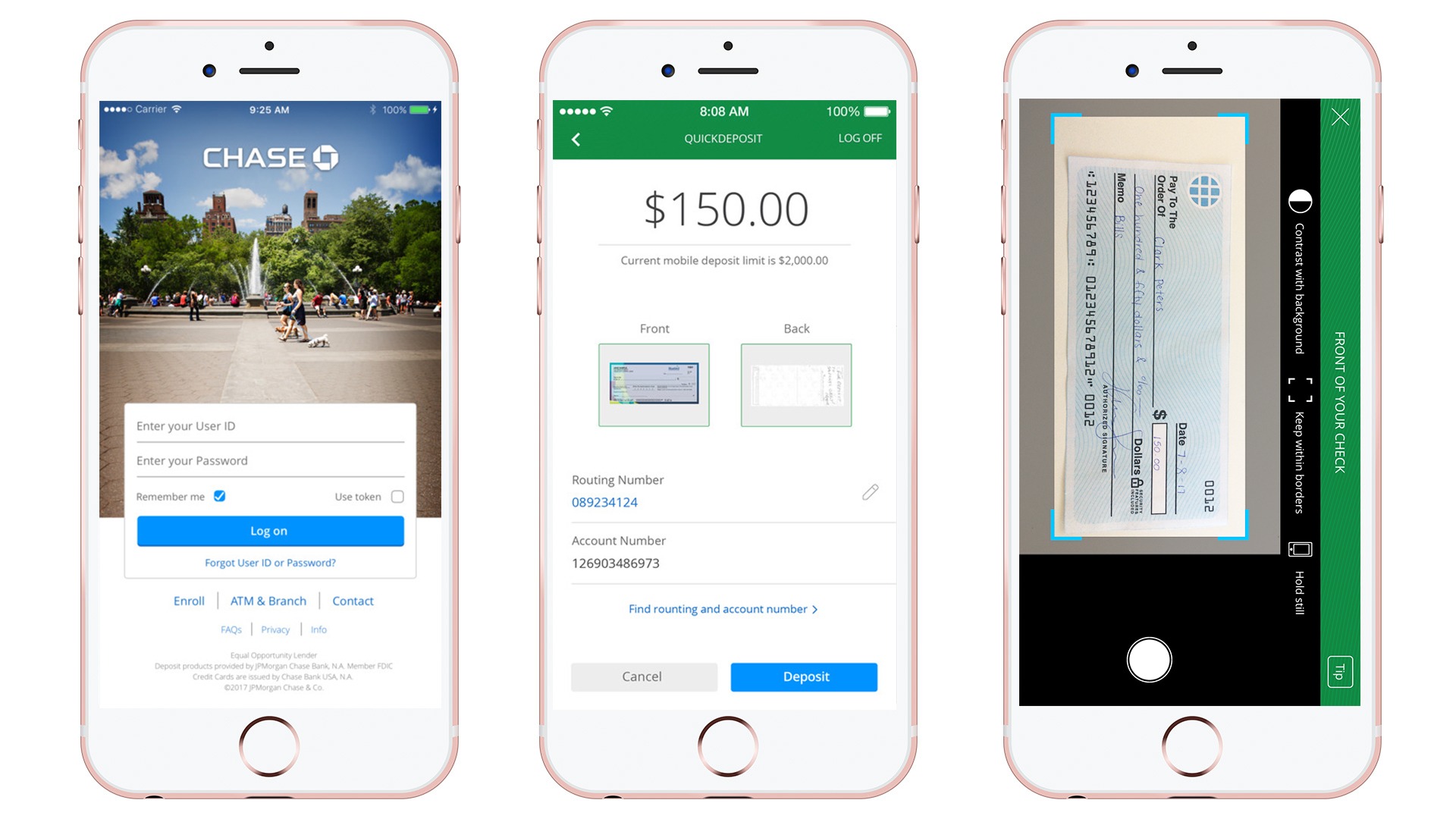

Enter the amount of the check and tap 'Front'. With our 'Auto Capture' feature, the picture of the front and back of the endorsed check will be captured — or you can choose to take the pictures manually. Verify your information and submit your deposit. After you submit, you can deposit another check. Sign your check. Open the app and tap Deposit in the quick-action menu at the bottom of the Welcome screen, then Deposit a check. Choose an account and enter the amount of the check. Take pictures of the check with your phone or tablet.

How it works:

Make sure your deposit information is correct, then select Deposit. You’ll get an on-screen confirmation and an email letting you know we’ve received your deposit. After your deposit, write “mobile deposit” and the date on the front of the check. You should keep the check secure for 5 days before tearing it up. Deposit checks in a snap. Deposit checks 1,2 right into your Schwab Bank or Schwab Brokerage and IRA accounts 3 using your Android™ device, iPhone ® or iPad ®. Available through our Schwab Mobile app. Download the app now.

Process all types of U.S. checks, drawn on any bank or credit union that is a Federal Reserve member, including personal checks, business checks, government checks and warrants, money orders and traveler's checks over the Internet. Using check truncation, the paper checks never leave your office and, in fact, should be destroyed after the successful deposit of funds into your bank.

The use of electronic check conversion - also known as Check 21, Accounts Receivable Check (ARC), Point of Purchase (POP), or Back Office Conversion (BOC) in banking terms - is among the fastest growing types of ACH applications due to its enormous benefits. Using our proprietary Internet-based Back office conversion 'Remote Deposit Capture' software and check scanning reader, you can scan conventional paper checks and transform them into an electronic check deposit. The software also stores the check data and check images in a database for future research and retrieval, re-submission of NSF checks and more.

You accept many checks each month from customers. Currently, you would have to look up each customer account, apply the payment to the account, stamp the check for deposit, create a deposit slip, drive to the bank, stand in a long line and make the deposit. On top of this, your bank will typically charge an 'item deposit fee' for every check you deposit. Too time consuming and too expensive!

- Prepaid Debit

Mobile Check Load

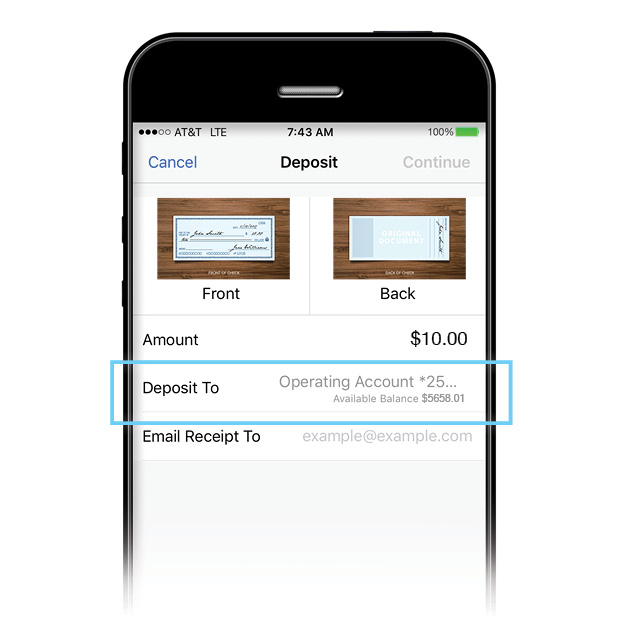

Load checks to your Card with your phone, using the Netspend® Mobile App.

Card usage is subject to card activation and identity verification.

You can load checks to your Card Account at your convenience without the hassle of waiting in line. Once the Card Account is funded, the money is yours to spend. And, it’s as simple as taking a few pictures.

How It Works

Here’s how to start using Mobile Check Load on your phone:

- Download the latest version of the Netspend Mobile App

- Select “Mobile Check Load” from the menu to the left

- Follow the on-screen instructions

You’ll be guided through how to take pictures of your check and given information about your loading options. In some cases, your money will be available in minutes!(fees may apply)

The Netspend Mobile App is available on Apple® mobile devices and Android™ phones.

Ready to change the way you pay?

Order a Card today, and you’ll receive it in the mail within 7-10 business days.

Deposit Check Online Capital One

Direct Deposit

Get paid up to 2 days faster with Direct Deposit

Have your paycheck or benefits loaded to your Card Account.

Optional Savings Account

PUT SOME MONEY ASIDE

It never hurts to save some money, and you can earn interest, too.

Send Money

SEND AND RECEIVE FUNDS

Transfer money to your friends and family.